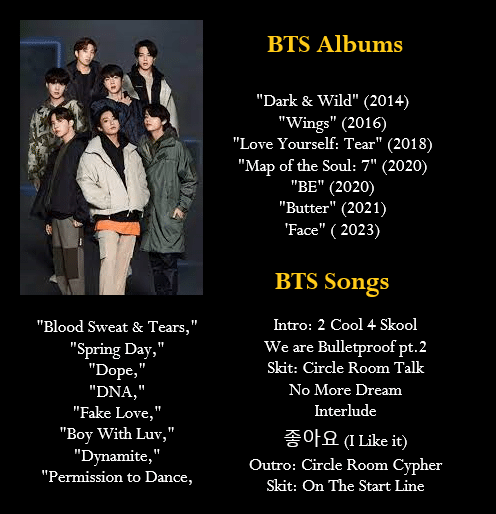

BTS All Songs List 2013 to 2024 In Order: BTS Best Songs List

BTS All Songs List 2013 to 2024 In Order – Songs & Albums List. The iconic South Korean boy band BTS, sometimes referred to as the Bangtan Boys has achieved popularity on a global scale. Numerous tracks from various albums and genres have […]

BTS All Songs List 2013 to 2024 In Order: BTS Best Songs List Read More »